Just this past week in November of 2022, we have seen so many events that reinforce the value of owning a real asset. A popular crypto company, FTX, was found to be incapable of paying out its customers and filed for bankruptcy. Stock values have plummeted for several popular stocks like Upstart, Vacasa and Carvana. The Federal Reserve has ratcheted up rates all year long and slowed mortgage origination to a crawl nationwide. Wells Fargo’s loan origination pipeline was down close to 90% from 2021 levels.

What’s an Investor To Do?

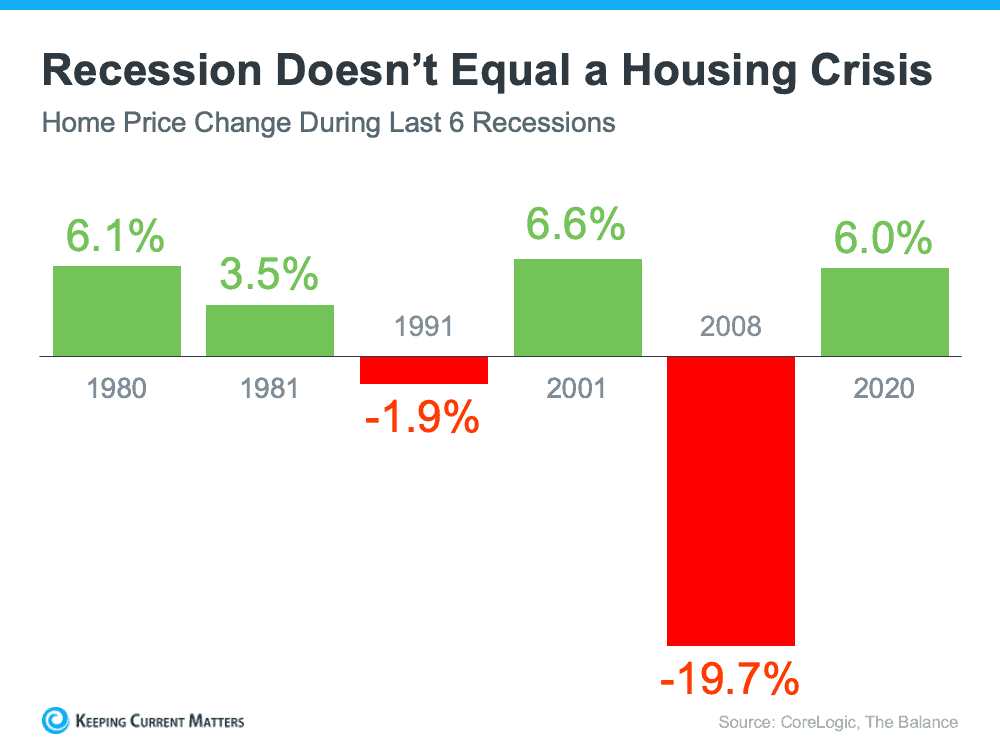

In the face of such precipitous drops in value, investors typically run toward real assets. Gold and silver are a real asset. Real estate is a real asset. Whether it be vacant land, a second home, a vacation rental or even commercial real estate, it’s commonly viewed as a “safe escape” during times of economic uncertainty. Did you know that during 4 of the last 6 recessions home prices actually went up?

Obviously 2008 stands as a major outlier and that was due to lax lending standards and a glut of foreclosures that rapidly depressed home values. Today’s lending standards are much higher and you can click this link to see how far foreclosures would have to rise to meet 2008-2010 levels. I want to show some examples of the damage done to 401ks and brokerage accounts over the course of 2022. If you think the 19.7% figure looks bad in the picture above, take a look at these.

Upstart – down 80% YTD

Vacasa – down 75% YTD

Carvana – down 93.5% YTD

These were very popular stocks during the Covid era, and it’s important to note how much wealth an individual would have lost by owning stocks like this. If you owned 10,000 shares of Carvana to start the year it was worth $1.847 million. Today those same 10,000 shares are worth $118,800. A loss of over $1.728 million.

And it could be worse than that! Investors in FTX and other crypto companies may see their entire investment wiped out and reduced to $0. Meanwhile somewhere in this country is a homeowner who bought in a sought after vacation destination area like the Outer Banks, where we just set a record for highest median sales price last month. His home value may not be up much in 2022, maybe not at all, but it has not gone to $0. This is the value of investing in a real asset like real estate – no matter what happens in the stock market or the crypto market, you own that tangible real asset. How many folks request the paper copies of their stock shares? Not many.

A Little Game of What If

I realize it’s a tough market for buyers and sellers right now – no seller wants to sell their home with a 2.75% mortgage rate and have to buy another one with a 7.5% mortgage rate. No buyer wants to buy a home and pay that 7.5% mortgage rate, knowing that rates were less than half that just a year ago. But let’s break down the potential outcomes with our current mortgage rates as a buyer in today’s market. Let’s say you buy a real asset like a beach house today, and the following happens in January of 2023.

Rates go up – You are happy that you locked in that 7.5%, because now it’s 8.5% and you would have lost buying power.

Rates go down – You are happy that you have an opportunity to refinance and lower your monthly mortgage payment.

Home prices go up – You are happy that you have gained equity in such a short period of time after buying a house.

Home prices go down – You aren’t happy about it, but you plan to hold onto it for 5-10 years, rent it out and use rental income to pay that mortgage that you locked in.

Now, will home prices go down nationally this year or next year? From July-September of this year home prices actually went up in 98% of US markets according to the National Association of Realtors. For the Outer Banks specifically, we have set several records for visitation and tourism over the last 2 years, and advanced bookings according to several industry sources I speak to are strong for 2023 as well. We also are a limited geographical area – most of Dare County is owned by the government and with the Cape Hatteras National Seashore occupying such a large percentage of beachfront acreage on the Outer Banks, there won’t be many new oceanfront homes popping up.

Furthermore most of the buildable land has already been built on, and this puts an extra layer of pressure on inventory that large metro areas don’t experience. You can build out the suburbs and expand the metro area in places like Charlotte or Phoenix. The Outer Banks is just barrier islands and we don’t have that luxury. So if demand increases in an area with a limited number of homes for sale, that puts upward pressure on prices.

Why Buying a Vacation Home Can Be a Good Investment Today

Let’s start with the obvious economic problem of today, which is inflation. With inflation, everything costs more. We see it in rising gas prices, grocery prices, and even home prices. What will not change in an inflationary environment are fixed long-term costs such as your fixed-rate mortgage. If your monthly payment is $3,000/month today, it will be $3,000/month 20 years from now. Most articles claiming real estate is not an inflation hedge neglect to mention that the money coming in from rental revenue frees up your personal capital for other revenue streams. Buying a real asset like a vacation rental home at today’s prices can pay off substantially over a 10-year window. Here’s a quick example-

You buy a vacation rental home for $1m in Nags Head today. The current jumbo rate at a local lender is 5.75%. You put 20% down ($200k) and finance $800k.

The home brings in $120,000 in advertised rent, and $95,000 in owner rent (rent after the rental company’s fees are charged to guests).

After all expenses on the home are paid including taxes, utilities, mortgage payments, etc you break even. Maybe you have an extra $5k/year to put into a maintenance/rainy day fund for home repairs and updates.

Home prices here have risen substantially the last 2 years but let’s assume a safe number of 3% per year (3-5% are commonly used ranges for annual appreciation over long periods of time).

If your rental revenue and expenses don’t change one bit, here’s where you stand after 10 years with the $1m beach house you bought in Nags Head. You owe $665k on your mortgage. Your home is now worth $1.344m. You didn’t have to pay a single mortgage payment out of your own pocket, because the home was cash flow neutral. You now have $679k of equity in this home.

But this ignores several benefits – if “everything” costs more over time, that includes rental rates. Your accountant may be able to find some tax benefits. If mortgage rates were to drop at any point you could refinance and lower the monthly mortgage payment, improving cash flow. You may even have made some memories by taking family vacations here at your beach house during the occasional week it wasn’t booked.

There’s nothing wrong with diversifying and certainly the stock market has performed very well for folks in the late 2010s-early 2020s. But the value of a real asset is that it has intrinsic value – it is incredibly unlikely (I don’t want to say impossible) for its value to ever drop to zero. Precious metals may not be at their all-time highs but they can certainly be liquidated for capital if the need ever arises. There will always be some intrinsic value, and the same can be said for real estate. The villain Lex Luthor from Superman had this to say-

“You can print money, manufacture diamonds and people are a dime a dozen, but people will always need land.” It’s the one thing we aren’t making anymore.

Lex Luthor – Superman Returns

That’s a pretty harsh take but there’s some real truth in his closing sentence. They aren’t making anymore. Much like the value of silver and gold is driven by scarcity and supply:demand, the same can be said for real estate. And here on the Outer Banks we have limited land to build on, and supply:demand will always be more of a factor for us. So if you are looking for a solid investment in an era of economic uncertainty, that beach house in Nags Head might just be worth considering. If you would like to learn more about our market just message me anytime – I would love to help you achieve your real estate goals!